Episode #18

The Dose Episode 18 – Income Allocation: Saving vs Paying Down Debt

March 12, 2019

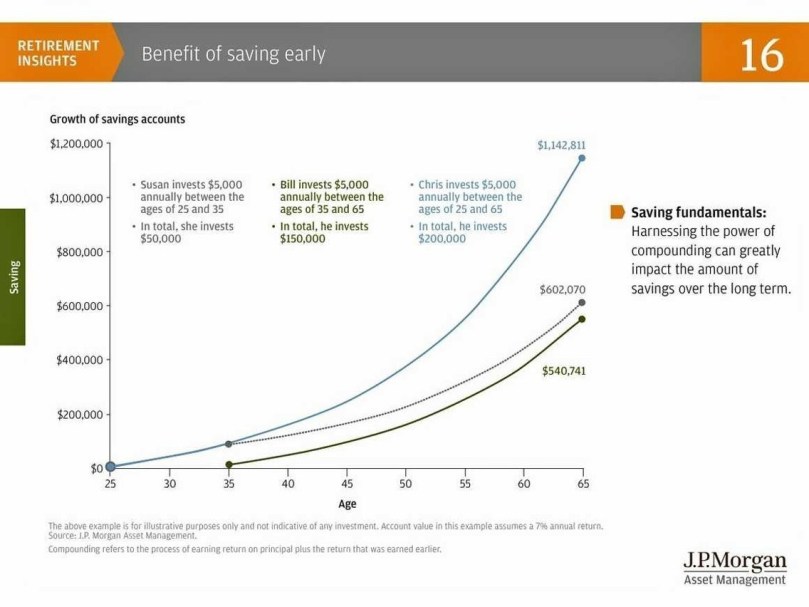

In this episode we talk about one of the most common questions I hear from optometrists: should I pay down debt or should I be saving for retirement? While every person’s situation is different, it’s important to understand the one theme and idea that’s constant in that equation: the time value of money and compounding interest.

During the show, I’ll discuss:

- How compounding interest works, using a snowman as an analogy

- A hypothetical example showing the real cost of waiting

- The max number of years you should take to pay off student loans while not saving for retirement

- The order and type of accounts you should consider when you start saving

- The power of habits and how to start small

Share