Why the media wants to scare the sh!t out of you.

October 27, 2018

Let’s make sure we’re all on the same page with one thing: the media does not care about your financial success. They don’t care about giving you good advice. They don’t care that the information they’re putting in front of you could, in the absence of objective interpretation of the data and how it applies to you, derail a financial or investment plan.

The reason that they don’t care is that their first obligation is not to you as a viewer, but to the advertisers that pay money to their organization. The hosts, contributors, writers, and moderators on TV are employees that first have an obligation to their employer and it’s agenda…not to you the viewer.

When you think about it, it’s an interesting cycle and chain of events that occurs. Ad placement and revenue are going to be dictated by viewership numbers and ratings. The more viewers they have, the more ad revenue they gather. Studies have shown that the more emotionally connected you are to a news story, the more inclined you will be to watch/listen/read. A phrase that is common in the hierarchy of news stories is “if it bleeds, it leads.” so a common practice is to sensationalize what otherwise would be simply “providing information and reporting the news” into a “problem that needs you to fix or take action on.”

Start Planning Today

Don’t miss out on exclusive access to financial tips, strategies, and expert-led webinars. Subscribe to the “Planning Life, On Purpose” newsletter today and stay ahead of the planning curve!

As discussed in a 2011 article from Psychology Today:

“Fear-based news programming has two aims. The first is to grab the viewer’s attention. In the news media, this is called the teaser. The second aim is to persuade the viewer that the solution for reducing the identified fear will be in the news story.”

“The success of fear-based news relies on presenting dramatic anecdotes in place of scientific evidence, promoting isolated events as trends, depicting categories of people as dangerous and replacing optimism with fatalistic thinking. News conglomerates who want to achieve this use media logic, by tweaking the rhythm, grammar, and presentation format of news stories to elicit the greatest impact.”

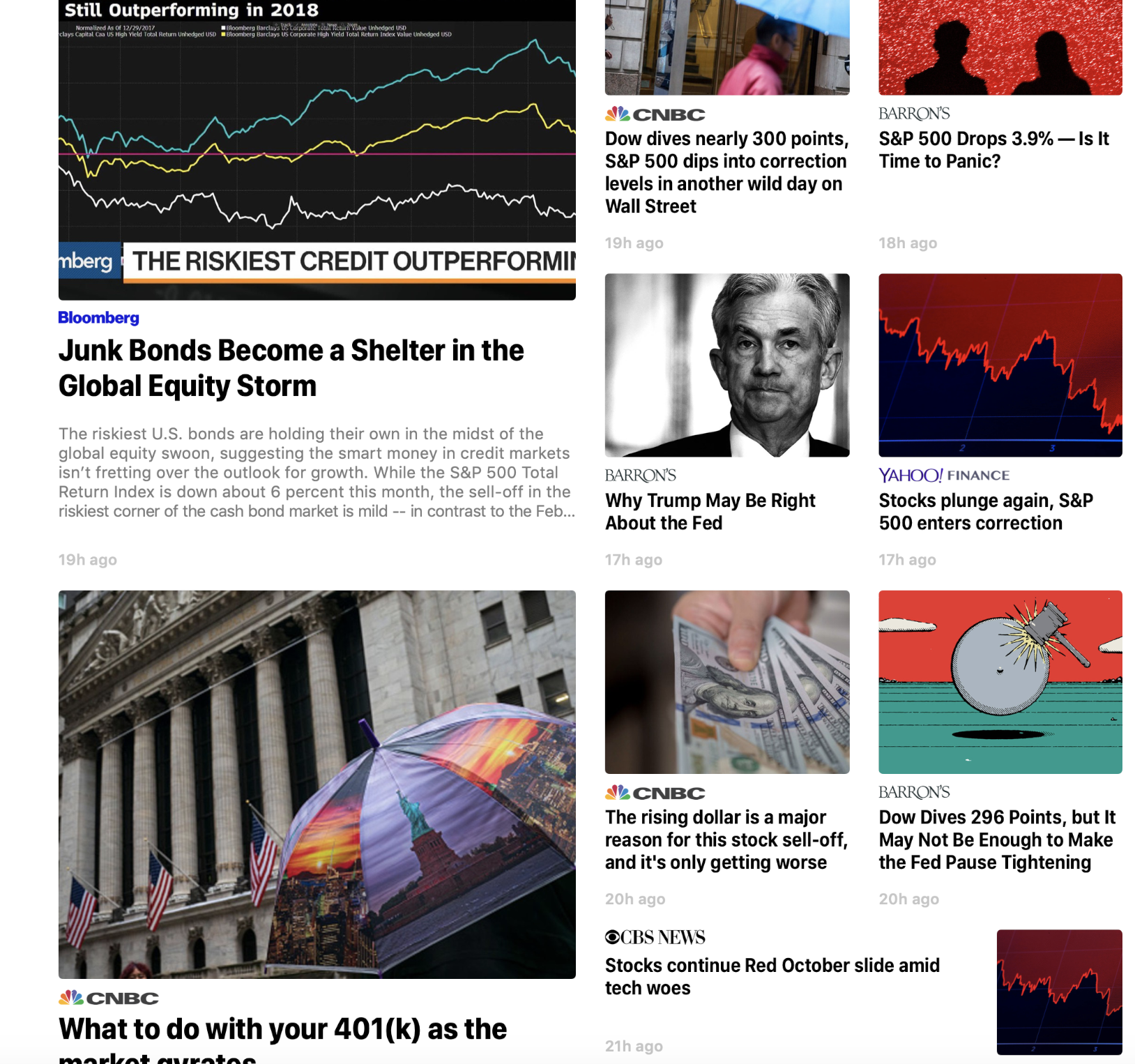

Just take a look at the screenshot from inside my Apple Stocks app from 10/27/2018:

Almost all of these articles include the two components of fear-based programming: it grabs your attention with a “problem” and leads you to believe that the answer to the problem lies within the article…rather than just reporting the news.

I also saw a tweet from a colleague that showed the correlation between the viewership numbers for CNBC (based on Nielson ratings) and the performance of the S&P 500 which I thought was both interesting and telling:

That’s a great idea in theory but they would never want to do that. They have a vested interest in red. pic.twitter.com/NqsYzGHuBD

— Zachary Mineur, CFA (@greenbackzach) October 26, 2018

So what’s the takeaway? Make sure you observe all the information that you take in through the filter of “What’s the motive behind this data?” Is it to inform you or is it to get clicks/eyeballs/readership?

Objectivity is key.

Share