Piloting your financial plan: when “going around” isn’t an option

July 7, 2020

One of my life’s passions is general aviation. There’s something magical about what we’ve been able to do as a species to create amazing machines that are able to transport us through the skies at all speeds and altitudes and it’s captivated me since childhood.

What goes up, though, must come down: eventually, the plane must land. Ask any (good) pilot what the secret to a perfect landing is and they will most likely answer something like this: “A perfect landing starts with flying a perfect pattern.”

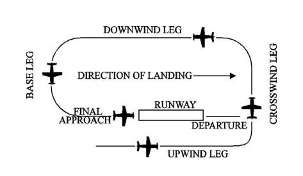

For an airplane that is coming in for landing at an airport, the three legs that are flown on the diagram are the downwind, base, and final approach. Even before a pilot enters the pattern, they’re always running through a variety of checklists to ensure that they haven’t missed anything that’s required to make safe and consistent landings.

Start Planning Today

Don’t miss out on exclusive access to financial tips, strategies, and expert-led webinars. Subscribe to the “Planning Life, On Purpose” newsletter today and stay ahead of the planning curve!

Notice the key words in the last sentence: safe and consistent. Is it possible to land an airplane without following the proper procedures and checklists? Sure. Is that an airplane that I’d prefer to be a passenger? Nope.

What does flying a safe and consistent perfect pattern to have to do with financial planning for optometrists? It’s a great metaphor to emphasize how a series of small, seemingly insignificant tasks done correctly compound to produce a successful result…and how missing those tasks or not anticipating them can lead to unanticipated results at best or accidents and disasters at their worst. Let’s go through the different phases of landing an airplane and correlate that to financial planning action items.

Entering the Pattern on the downwind leg. Proper communication is key when flying. When flying at a non-control towered airport, radio calls are made to announce who you’re talking to, who you are, where you are, and what you want to do. This lets other pilots in the area start to visualize where you are in the airspace so they can plan their moves accordingly. Even before the pilot is in the pattern, they’re taking inventory of not only other traffic in the area (variables outside of their control) but also different items inside the cockpit such as fuel, engine performance, airspeed, and altitude (variables under their control).

Just as communication is important in flying, so too is it in financial planning. Proper communication serves many benefits to multiple parties. It’s important to communicate your goals and intentions with not only your family (spouse, kids, etc.) but also with the other key advisors and relationships in your life. You should be able to accurately state not only where you are currently, but also where you want to go and what you want to do. You can’t just “think” or “wish” your way to financial independence. Everyone wants financial independence, but there’s a difference between wanting it and being willing to do the tasks and planning necessary to get there. Harvey Mackay says that “A dream is just a dream. A goal is a dream with a plan and a deadline.”

Turning base and final approach. Turning onto your base leg is a key position in the landing process. You want to make sure two items are on target: airspeed and altitude. The interesting thing about the base leg, though, is that the consequences of NOT hitting your numbers really aren’t felt at this point in the landing process. If you “didn’t know what you didn’t know” you’d think that everything was still going just fine…you’re on your way to the airport.

Here’s what’s interesting, though. The compounding effect of missing those numbers on your base leg really show up when you turn onto final approach. Too high and fast and now you have the task of trying to dissipate altitude by reducing power while maintaining a stabilized approach and attitude. Too low and slow and you’ll be adding power to maintain altitude while maintaining attitude. While there’s already enough to be cognizant of while landing, you now have an additional workload to manage.

All of this is happening as the runway gets closer and bigger in your windscreen. The margin of error gets smaller, your ability to correct these miscalculations reduces, and the evidence of your errors become amplified.

Going around. In the end, though, the pilot always has one last arrow in the quiver: the go-around. If she doesn’t like the way things are setting up, she’ll “power up, pitch up, and clean up” the airplane to initiate a climb to go around and give it another try.

However, in financial planning, you don’t have the option of a “go around.” The runway (retirement, financial independence…call it what you will) is getting closer and closer with each passing day, week, month, and year. The closest thing ODs have to that arrow in the quiver is the equity value they have in their practice. The traditional private practice with a stand-alone location will have a certain amount of value, but in my experience working with ODs, (a) it’s usually a lot less (after taxes) than the OD thought it would net them and (b) it can be even lower if the practice isn’t running efficiently and “primed” for a sale. Owning the real estate can be an additional asset, but it’s rarely enough to fully supplement an optometrist’s retirement income needs once they’re done practicing.

A corporate-affiliated OD doesn’t have that arrow in the quiver or, if they build their practice to the point of selling it, will not command the same value for the practice as the traditional valuation methods because the business model is inherently different than the traditional private practice model. There isn’t any real estate (other than a lease) and there are other factors at play as well in the overall valuation of a corporate affiliated practice.

The two key variables in the landing pattern are altitude and airspeed. Hit those numbers at the key points and the chances of having a smooth and uneventful landing are significantly increased. In retirement planning, we can replace airspeed and altitude with “time and savings rate” (savings rate being the amount of your gross income you are saving for retirement). Make sure you understand the impact of these two most important variables in your financial plan so that you don’t need to “go around” when going around isn’t an option.

Share