Achieving success by avoiding failure

August 15, 2024

“It can be difficult to appreciate how much simply avoiding the standard ways of failing dramatically increases the odds of success.”

This quote, which I came across while reading the Brain Food Newsletter, resonates deeply with our shared professions. In optometry and personal finance, success often hinges on proactive care, identifying and addressing issues before they escalate, and avoiding unhealthy behaviors.

Consider the parallels between eye health and financial health. Just as regular eye check-ups are essential for maintaining clear vision, periodic financial assessments are crucial for long-term prosperity. By encouraging our patients (i.e. clients) to conduct regular check-ups and seek professional guidance, we can help them identify and address potential challenges before they become insurmountable.

Start Planning Today

Don’t miss out on exclusive access to financial tips, strategies, and expert-led webinars. Subscribe to the “Planning Life, On Purpose” newsletter today and stay ahead of the planning curve!

Moreover, the quotation’s emphasis on avoiding standard ways of failing aligns perfectly with patient care. Just as you strive to provide personalized treatment tailored to each patient’s unique needs, individuals must also tailor their financial strategies to their specific circumstances.

As an optometrist, you have the power to help a patient understand the importance of regular eye check-ups and how they can prevent major eye issues in the future. Similarly, in financial advising, we empower clients to understand the importance of regular financial assessments and how to prevent major financial problems. By avoiding one-size-fits-all approaches and instead focusing on customized solutions, individuals can better navigate the complexities of their health. This principle holds true in both patient care and financial advising.

As professionals in our respective fields, we inherently know some of the most common pitfalls for patients’ eyes and clients’ finances. We work diligently to help clients avoid these common pitfalls:

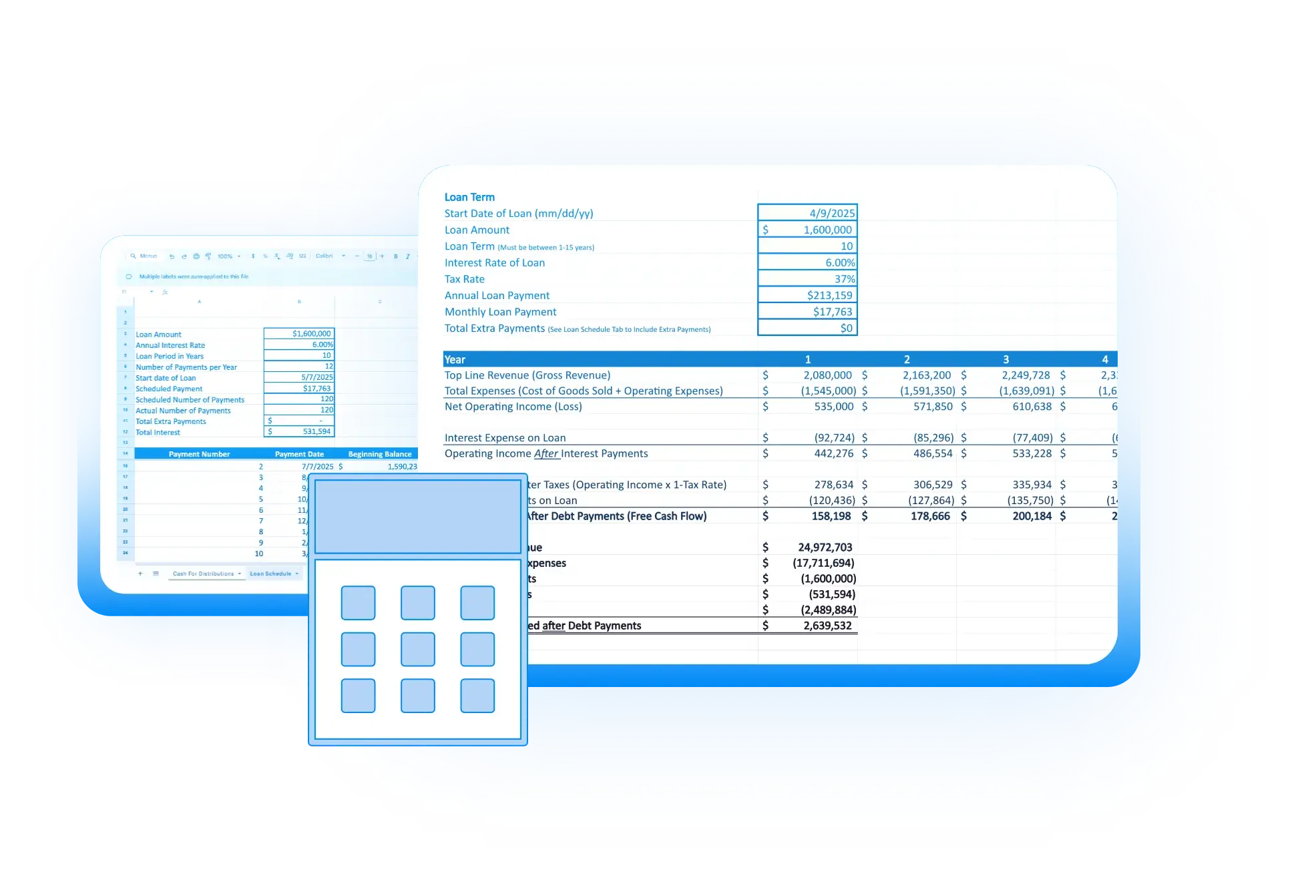

1 – Incomplete, out-of-date, or inaccurate business balance sheet, statement of cash flows, and Profit & Loss statement. By proactively looking at your business financials, you can see problems before they start.

2—Not automating payments to retirement, savings, or extra loan payments. Thinking you will ‘do it later’ typically means it will not happen. By automating, you are starting your savings journey now before it’s a big problem later.

3 – Expectations growing faster than your income. When you ‘get the goalpost from stop moving‘ your relationship with money will be forever changed. It’s an easy concept but hard to implement.

Furthermore, the discipline and attention to detail required in your profession translate seamlessly to your personal finances. Just as you meticulously examine each patient’s eyesight to identify potential issues, we must continue to collectively assess your financial situation to identify potential risks and opportunities. By staying vigilant and proactive, we can help avoid common financial pitfalls, achieve greater peace of mind, and dramatically increase the chance of your financial success.

(Note: if you want to embrace this journey via “guided independence,” we’d suggest looking at the 20/20 Money Membership.

Share