A revised take on the new 199A QBI deduction for optometry practice owners

August 8, 2019

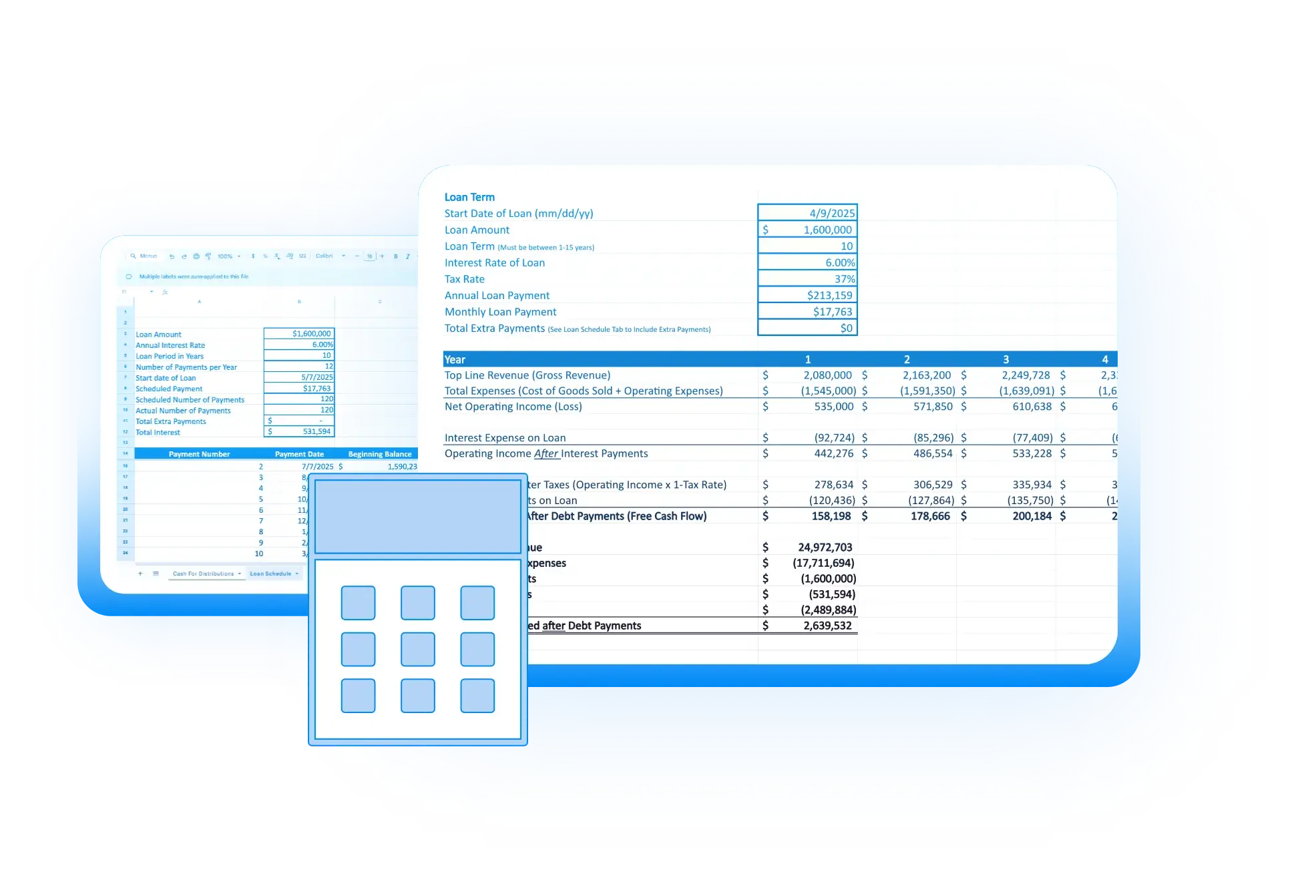

With the passage of the Tax Cuts and Jobs Act in late 2017, many optometrists and their team of advisors have probably been trying to figure out the best way to maximize the benefits of the new Section 199A (QBI) deduction. However, the Treasury Department has come out with a great deal of guidance on this deduction and it has caused ODs and advisors alike to rethink the way in which they plan for and use this deduction.

Specifically, ODs should be clear and confident in understanding the impact profit-sharing contributions to their plan have on the amount of the 199A deduction they can claim, specifically the part of the profit-sharing contribution that is allocated to the practice owner.

In my latest article on Review of Optometric Business, I share more details on this way of thinking along with a specific example that helps illustrate why automatically max-funding a profit-sharing plan may not be the best choice for optometry practice owners.

Start Planning Today

Don’t miss out on exclusive access to financial tips, strategies, and expert-led webinars. Subscribe to the “Planning Life, On Purpose” newsletter today and stay ahead of the planning curve!

Share