Episode #208

20/20 Money Episode #208 – Don’t get “spooked” by a surprise tax bill: capital gain distributions during a market downturn—and how to plan accordingly

October 31, 2022

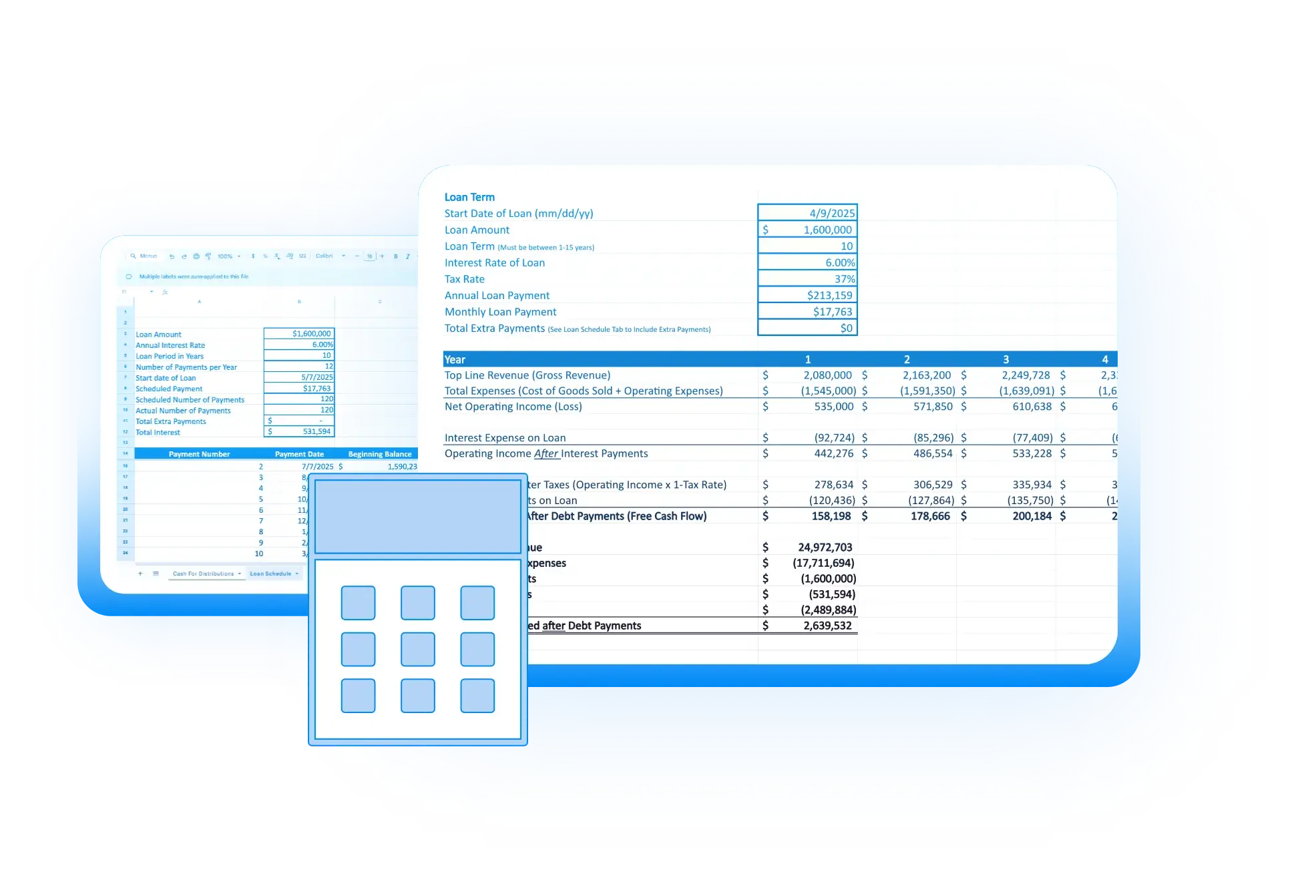

Welcome to this episode of 20/20 Money! On today’s show we discuss the relationship between tax loss- and gain-harvesting and capital gain distributions from ETFs and mutual funds. We’ll run through a couple of examples of how you can proactively review your portfolio and potentially reduce your tax liability and not be surprised by a large 1099-DIV report during 2023’s tax season.

As a reminder, you can get all the information discussed in today’s conversation by visiting our website at integratedpwm.com and clicking on the Learning Center. While there, be sure to subscribe to our newsletter and you can also set up a 20-30min Triage conversation to learn a little bit more about how we help OD practice owners around the country reduce their tax bill, proactively manage cash flow, and make prudent investment decisions to help them live their best life on purpose or check out any number of additional free resources like our eBooks, blog posts, and on-demand webinars.

Resources:

Start Planning Today

Don’t miss out on exclusive access to financial tips, strategies, and expert-led webinars. Subscribe to the “Planning Life, On Purpose” newsletter today and stay ahead of the planning curve!

Fidelity’s Tax Loss Harvesting article

Share